Peoples’ Self-Help Housing (PSHH) a network member since 2011, is an experienced developer with a strong team, a great track record, and a reputation for providing high-quality homes and services in some of California’s most challenging markets for developing affordable housing. In their nearly 50 years, they have developed more than 1,800 homes with more than 5,000 tenants.

Housing for Farmworkers

PSHH first reached out to us after putting an offer on Guadalupe Court Family Apartments in Guadalupe, CA, a property that we already underwrote and helped another NeighborWorks Organization acquire.

Guadalupe is a small city surrounded by agricultural land with a large farmworker population. Vegetable and fruit farming, especially strawberries and grapes, dominate the local economy, which is supported by low-income workers who struggle to meet coastal California’s high rents and home prices.

Since we were familiar with the market and the risks, we were able to underwrite the deal quickly and get the loan approved with ease. PSHH’s strong track record helped minimize the risk of the deal.

“NC offers great flexibility and good terms. They are always there when we need them, in any jurisdiction. We have used local housing trust funds—but we work in three counties, and those are geographically restricted and don’t always offer acquisition financing. NC is well-capitalized, and able to take on any size project we need,” said Morgen Benevedo, Director of Multifamily Housing Development for PSHH.

We worked with PSHH to move the project ahead. We settled on a $775,000 36-month acquisition loan for PSHH to acquire the 2.85 acre property. PSHH will develop 38 one-, two- and three-bedroom apartment homes at maximum 60% AMI ($47,800), targeted to low-income farmworkers and their families. PSHH will aim for LEED Platinum with net zero energy, solar, and an innovative water efficiency program, including a laundry-to-landscape gray water system, as well as native and drought-tolerant landscaping.

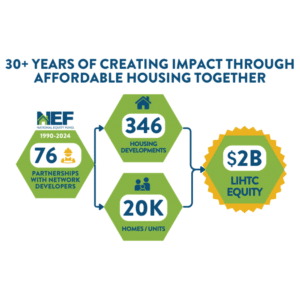

The project is funded through a 9% LIHTC and USDA 514 housing loan for farm labor housing. After closing on this loan, PSHH was quickly able to get LIHTCs. They are closing on construction financing and hope to break ground before the end of the year.

“In this business, flexibility is everything. You know something will change—there’s usually a surprise around the corner. Having a partner who understands that and gives you the leeway you need to take care of those things makes a better project in the end. That additional time made for a stronger and less risky project at the end of the day,” Benevedo said.

“We are invested in the projects that we help finance, and being able to help the communities and families these projects serve is very important to us. Our continued involvement in the Guadalupe Court project is part of our commitment to making sure the affordable housing developments come to fruition,” our Senior Loan Officer Tamar Sarkisian said.

Affordability in Ventura County

Because of our established and successful working relationship, PSHH came to us on another acquisition loan soon after the first closing.

PSSH built a 40-unit building and single-family homes in Ventura County years ago, but their interest was renewed and they found an opportunity in Fillmore.

“Ventura County and Coastal California are highly impacted by high costs, whether that’s home ownership or rental. Ventura County has restricted residential growth, so that’s impacted pricing as well. There is high demand for affordable housing that hasn’t been met. We saw this as a great opportunity to develop,” Benevedo said.

When the Fillmore Apartments became available, PSHH found itself in need of a partner to provide acquisition financing. When local resources wouldn’t work, PSHH again reached out to NC. “Again, NC was right there and willing to be flexible to the project’s needs,” Benevedo said.

We worked out a $1.275 million 36-month acquisition loan for 1.4 acres of vacant land in Fillmore, CA, where PSHH will develop Fillmore Apartments, 72 apartment homes at maximum 60% AMI ($57,600.) The project is funded through 4% LIHTC, tax-exempt bonds, and Affordable Housing and Sustainable Communities (AHSC) program soft financing. This acquisition loan closed in spring 2018, and construction will begin in 2020.

PSHH is aiming for 50 units/acre, a dense site with a combination of two- and three-story buildings to maximize density because of the high need for affordable units. Also, they aim to go green, with solar, net zero, and energy efficient appliances. They also will feature their standard amenities such as a community room, onsite laundry, play area and outdoor spaces, as well as their education centers for after-school programs. These centers have seen great success in helping students improve their grades and move on to college.

“Establishing good relationships is paramount to the work we do. Once we have that, like we do with PSHH, it makes it easier to achieve the tailored, flexible financing they need, and for us to underwrite and close the loans we work on,” Sarkisian said.

PSHH is a national award-winning non-profit organization that creates affordable housing and self-sufficiency programs on California’s Central Coast — San Luis Obispo, Santa Barbara, and Ventura Counties. Formed in 1970, it is known for its high-quality developments and excellent relationships within the communities they work. PSHH had seven projects under construction in the last year.