As part of our series to help you better get to know our staff, we’re asking a few key questions every other month. This month, we feature NeighborWorks Capital’s CEO Jim Ferris, who has been with us since 2007. Jim has 35+ years of senior management experience in both private and nonprofit organizations, and extensive knowledge in real estate development, capital markets, and affordable housing finance. He’s also, as a native of Springfield, a font of knowledge about all of the Massachusetts programs.

What is your personal mission? How does your work with NeighborWorks Capital advance that?

My mission is to assure everyone has a decent and affordable place to live. It’s informed by my personal experiences and the variety of work I have done over the past several decades. Having lived in more than nine houses in Massachusetts before I was in high school meant that I needed to know I had a safe place for my five siblings and me. This ignited my curiosity each time we moved, and I would explore my new street and my neighbors, learn about the community and where to play, get to school and worship, and where to shop at the local businesses.

That early experience inspired me to continue that in my studies. I loved the variety of housing architecture I saw, so I considered a career in architecture. My practical side sent me into accounting and finance in college, which resulted in my first job as a real estate accountant. There I gained skills in real estate development and commercial real estate finance, including offices and market rate multifamily. That built my knowledge of private sector and institutional financing as a Controller for some private real estate companies in Boston. When the commercial real estate market collapsed in the late 90s, I was laid off when the organization went into bankruptcy.

It was perhaps luck or destiny that my job search found me interviewing for a Director of Finance position at a “non-profit affordable housing” opening at Codman Square Neighborhood Development Corporation in the Dorchester neighborhood of Boston. When I was hired, I thought I knew everything required to fulfill my responsibilities – but I quickly realized I did not. At first, I drank from a large fire hose about board reporting, making payroll, affordable housing financing (LIHTC, CDBG, Section 8), battling predatory lending, and community outreach. It was the biggest learning experience of my career, but also expanded my connection to the importance of a community where disinvestment was prevalent but where there was hope, engaged community partners and momentum!

What keeps you interested in Community Development Finance?

During my tenure at Codman Square, I later became the Executive Director and expanded its programs and strategies into senior housing, home repair, homebuyer lending, commercial district revitalization, resident services and after school programs – what we now call comprehensive community development. Financing tools included LIHTC, HUD 811, CDBG, Historic Tax Credits, to name a few. We had no guidebooks to follow at the time, but a network of collaborators. I was fortunate to be introduced to Ken Wade in the New England District of NeighborWorks America. He encouraged Codman Square to apply for affiliation and we were chartered in 1996.

When I later left Boston to expand my community development experience, I landed in Seattle as Executive Director of the city’s largest affordable rental housing developer and owner. I continued expanding my CD tools with tax exempt financing, 4% LIHTC, HOPE VI replacement funds, HUD 811, and direct financing with regional and national banks and LIHTC investors. In my desire to expand my knowledge I landed at Fannie Mae Foundation in Washington, DC, working across the country with some of the largest nonprofit affordable multifamily developers to share best practices from their experiences. This broadened my network of knowledge and colleagues, so when the foundation closed its doors in 2007, I was able to combine my affordable housing development and finance experience as the next CEO of NeighborWorks Capital, in a community of excellence that I knew and loved!

NC was formed to bring resources to the networks’ community developers. The community development finance sector is here to help move things forward and address a critical gap in the finance system. For NeighborWorks Capital, it is affordable housing. I knew that assembling capital for each new project could be time consuming, inefficient and unpredictable. From concept to completion each project can take three to six-plus years, and large sums of money to get to the finish line. I remain interested because we have a role to streamline that financing process and a desire to meet each organization’s housing mission. No two communities are alike, as you would expect, and no two projects’ financing needs are alike. That makes it both challenging and rewarding.

What’s your proudest accomplishment at NeighborWorks Capital?

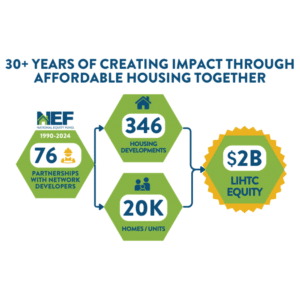

I am proud to lead NeighborWorks Capital which serves a national network of community organizations that are making a huge difference in addressing inequities of race and housing. Their work continues to inform our board and staff, to bring additional financing resources for continued impact. I am proud that NeighborWorks Capital has raised over $140 million in capital, expanded its products from two to seven, and has provided loans to over 120 network organizations in 14 years. And I am pleased to have a board and staff that continue to motivate and innovate – always learning and flexing!